Since 1990 GCI has well-tempered the focus on UNFCCC-Compliance with C&C

C&C & the Rajan Carbon Tax Proposal

Click logo to return to 'links-page'

Click logo to return to 'links-page'

C&C or Doing Enough Soon Enough for UNFCCC-Compliance is like

playing in time & in tune in music in a cadential structure of 'closure'.

It means Equity Equals Survival.

*********************************

In December 1997, a C&C-based way-ahead was debated in the final session of COP-3,

with strong interest from India, China the Africa Group the USA. The United States stated,

"C&C contains elements for the agreement that we may ultimately all seek to engage in."

GCI proposed Contraction & Convergence, Allocation & Trade at COP-2 in 1995.

In 2009, Adair Turner, then Chairman of UK Climate Change Committee,

told the Parliament that C&C is the basis of the UK Climate Act (UKCA).

*********************************

Are C&C + the Rajan-Carbon-Tax-Proposal compatible? Open/download this pdf file

into Acrobat Reader. There are 42 slides in this 'heuristic', suggesting the answer is 'yes'.

In his Reith Lectures, Carney described this as

"the first best option (but which was never going to happen)."

Without a full-term carbon-cap, the tax is meaningless. With it however, the second key

to the structure is reconciling the tension between over & under carbon-consumers.

Indexed to the rising price of carbon and the contraction of emissions, you can keep an eye on

the closure between the 'debits' & 'credits' between carbon-debitors & carbon-creditors.

This is equivalent to contraction with immediate convergence as argued by the Government of

China at COP-15. You can tap through the present slides (2020 - 2040) one-by-one.

Renewable replacement rates

There are 42 slides in this 'heuristic'.

Each slide is identical except . . . .

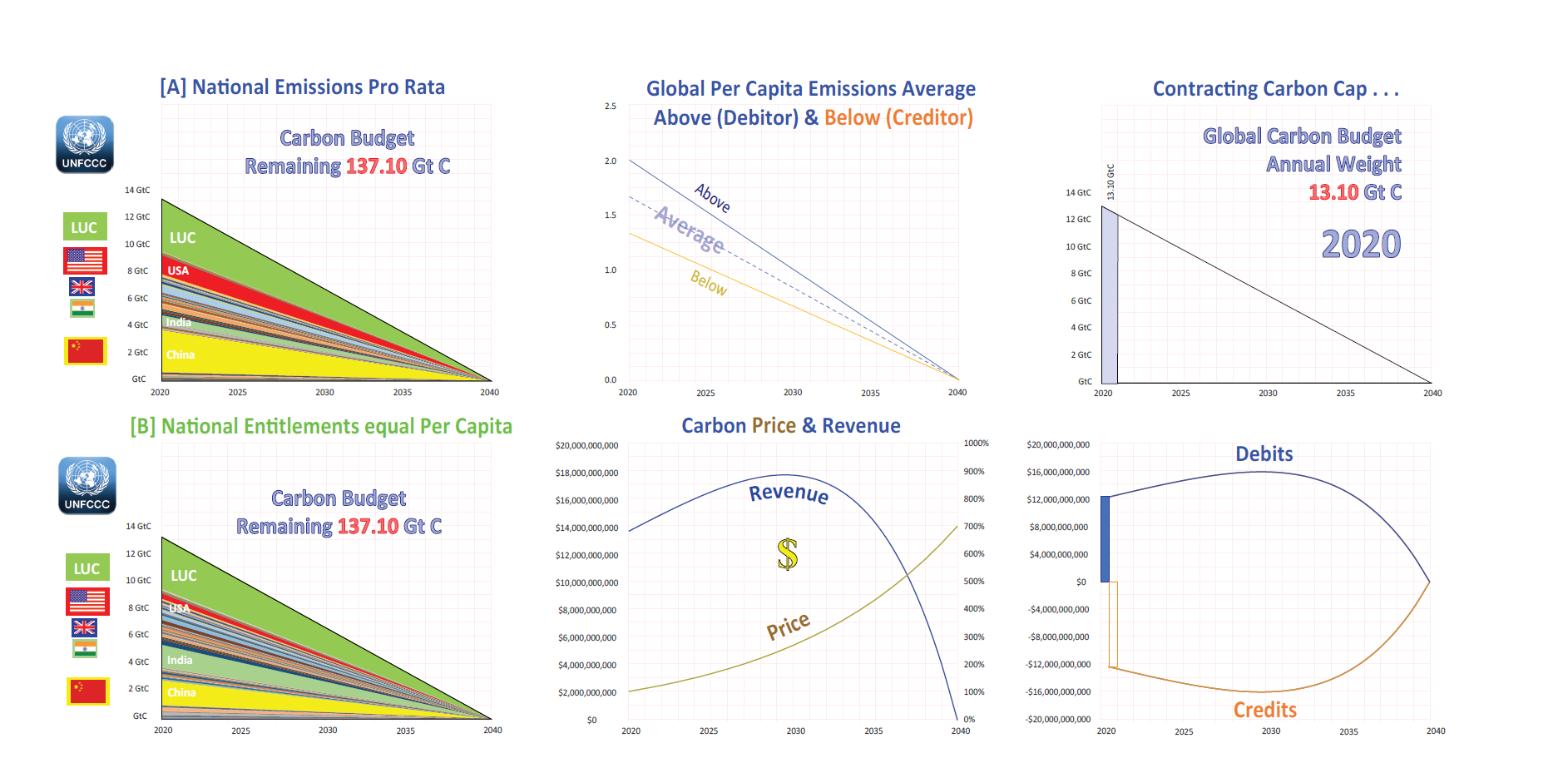

[a] each slide shrinks by 1/20th of the total carbon budget weight (137.5 Gt C)

annually from 13.1 Gt C in 2020, to absolute zero Gt C in 2040.

[b] All weights (cumulative & marginal) are shown counting down for each year.

[c] The debit/credit balances expressed as global $s are shown for each year calculated

above & below the global per capita average of carbon emissions of the global budget.

[d] within this structure carbon-debitors pay into a global fund

while carbon-creditors withdraw from it.

[e] with a population base year for 2020 (7.5 billion).

It may seem 'dry' but this is quite deliberate.

[f] As with the carbon, all net calculations have been purged from these accounts.

[g] Globally aggregating any 'net-calculations' is only relevant to that absolute calculation,

which obviously has to be done first.

[h] The procedure shown, halves global emissions between 2020 & 2030 -

i.e. minus 50% (to avoid "uncontrollable ecosystem collapse" (Figueres),[i] & completes to -100% by 2040 which (sadly) still adds

(albeit) declining amounts of CO2 to the global atmosphere.

*************************************************************

This time with feeling.

*************************************************************

Over the years the C&C approach generated a lot of support from inumerable persons

As this recent comment from Christiana Figueres clearly shows were on the clock now

- The slower we act the faster the rate of damages & potential collapse will be

- The faster we act the slower the rate of damages will be, avoiding potential collapse.

To act collectively we need a structure of 'truth and reconciliation'.

Combining C&C with what is a global Tax & Dividend proposal from Rajan is another way of providing this.

Boris Johnson stated in Parliament that all countries will have enforceable targets by COP-26.

This inclusivity requires a unifying C&C strategy. Border taxing carbon is divisive & will not achieve it.